Buying on margin is basically getting a loan from your firm to buy securities. When you buy securities on margin, you must repay both the amount you borrowed and interest, even if you lose money on your investment. Buying margin refers to borrowing from a brokerage firm (through a margin account) to make an investment.

Margin debt allows investors to make investments with their brokers' money. But they can also add to your losses, and in some cases, a brokerage firm can sell your securities without notification or even sue if you do not fulfill a margin call. For these reasons, margin debt is generally for more sophisticated investors.

When purchasing securities through a broker, investors have the option of using a cash account and covering the entire cost of the investment themselves or using a margin account. The portion the investor borrows is known as margin debt and the portion they fund themselves is the margin.

Bill wants to buy 1,000 shares of Apple stock for $100 per share. He doesn't want to put down the entire $100,000 at this time. His broker is willing to lend him 50% of the initial investment. He deposits $50,000 in initial margin, while taking on $50,000 in margin debt. The 1,000 shares of Apple he then purchases act as collateral for this loan.

Apple's share price rises to $150. Bill's 1,000 shares are now worth $150,000: $50,000 of that is margin debt and $100,000 is equity. If Bill sells the shares, he receives $100,000 after repaying his broker, his return on investment (ROI) would be:

ROI = ($100,000 from selling shares – $50,000 initial investment) ÷ $50,000 initial investment = 100%.

NOTE: If Bill had purchased the stock using a cash account, he would have had to cover the initial investment of $100,000, his ROI would be:

ROI = ($150,000 from selling shares – $100,000 initial investment) ÷ $100,000 initial investment = 50%.

NOTE: In both cases his profit was $50,000, but the margin account freed up capital for Bill to invest in other opportunities.

Apple drops to $60. Bill's margin debt remains at $50,000, but his equity has dropped to $10,000: the value of the stock (1,000 × $60 = $60,000) minus his margin debt. There is a maintenance margin requirement of 25%, meaning Bill's equity must be above that ratio in the margin account.

Falling below the maintenance margin requirement triggers a margin call, unless Bill deposits $5,000 in cash to bring his margin up to 25% of the securities' $60,000 value, the broker can sell his stock until his account complies with the rules.

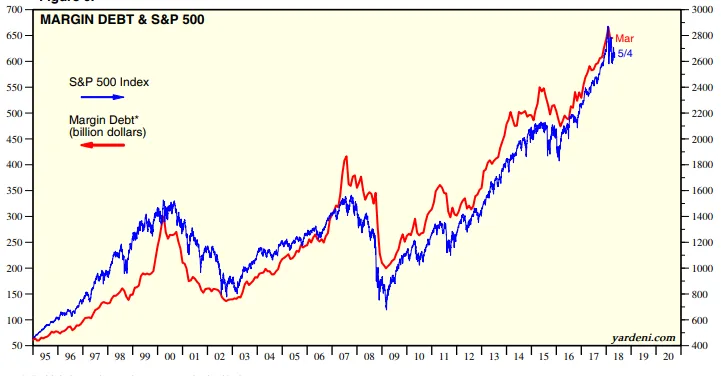

According to FINRA's latest margin statistics, borrowing by investors in January 2018 stood at an all-time high of $665.4 billion. Some market watchers use margin debt as an indicator to anticipate market downturns. So it wasn’t any surprise to these market watchers that the Markets fell by 10% and entered correction territory in February.

History tends to repeat itself. The precursor to the 2000-2002 and 2007-2009 bear markets was margin debt shooting up, peaking and then dropping. When it began to peak and drop, the S&P 500 followed soon after.

As you can see from the chart, when the red line (margin debt) starts to make lower highs, the S&P 5000 soon followed afterwards. For those who can't follow the Markets everyday, just following a few indicators may save you 25%-50% of your account(s).

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.