All the alt-media icons and market gurus have been wrong, and repeatedly wrong with their predictions that gold & silver will skyrocket to amazing prices.

So after years of the "experts" getting it wrong why would anyone still think that?

Because the economic model fundamentals suggest ...

I will keep this post brief, but a deep discussion needs to be shared about the flawed economic models.

The models don't account for crimes by institutional forces that control the public narrative (mass media, false beliefs and habitual confidence or order followers), and institutional forces that create as much "money" as they require.

The economic model doesn't model the real Ponzi-Economy.

Be Prepared!

No, the economic models are all flawed, and when gold & silver breaks out it will be a emergency event that will harm a lot of people worldwide.

That is why I think having gold or silver is an insurance policy ready for the eventual emergency.

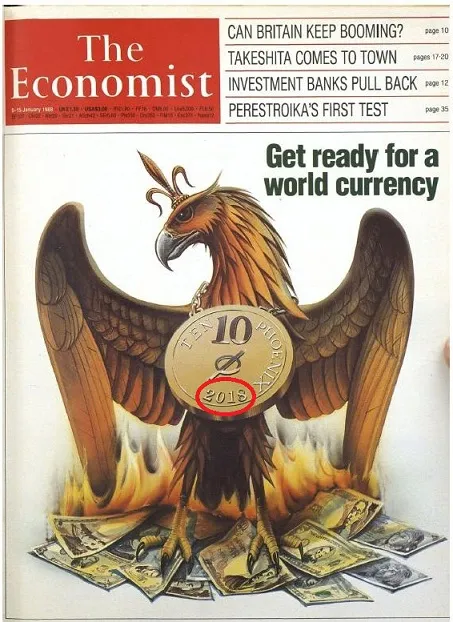

The central banks have already signaled they plan to manage a major market correction soon.

Soon, as in by the end of this calendar year and certainly in 2018 - so a series of market disruptions and corrections may be coming before the end of 2018 and when the bankers decide to pull the plug for what they call market corrections and also because they need an emergency event to implement additional policies and reforms to "reset" their worldwide monetary system.

Modi's Demonetization Is a Cure Worse Than The Disease For India ...Dec 2, 2016 forbes.com

They have funded hundreds of billions into blockchain tech, "FINTECH", biometric-bankcards, digital banking, and supercomputers over the years and they have seen the results from tests and trials with cryptocurrencies, and "demonetization" policies such as what happened in India and is planned for in Europe and elsewhere.

The European Central Bank will phase out the 500-euro note by the end of 2018. nytimes.com May 4, 2016

For the individuals who are speculators and wish to profit from the rigged game (markets & the 4th industrial revolution with cryptocurrencies in the digital economy - aka cashless society) then it is a no brainer - you see their script and scam. It is easy to profit from it, but remember to also keep your insurance in tangibles and skim off some of the returns into gold & silver or other physical assets (property or local services) to keep outside of the banks' FINTECH industry.

Read:

Pressure To Rollout Central Banks & Governments Blockchain Policies

Lacy Hunt: The Fed Has Undermined The Economy's Ability To Grow!

The Digital Economy: Central Banks Cloning Bitcoin For National Currencies

CASHLESS SOCIETY: Central Banks' Cryptocurrencies

If you find this information useful or of value then please share it with others.

Re-steemit forward. Re-steemit so others can see this too.

If you like this post, do not forget to  upvote or follow me and resteem

upvote or follow me and resteem