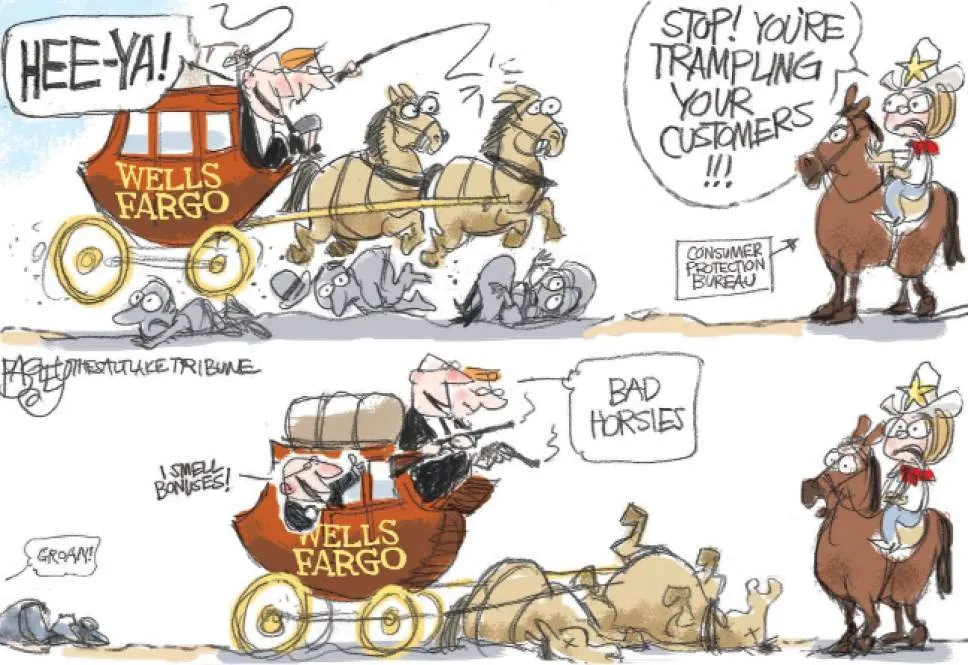

If you are a CEO of a Huge Financial Organization, you too can get away with Fraud... At least this is what is implied with the recent Wells Fargo debacle.

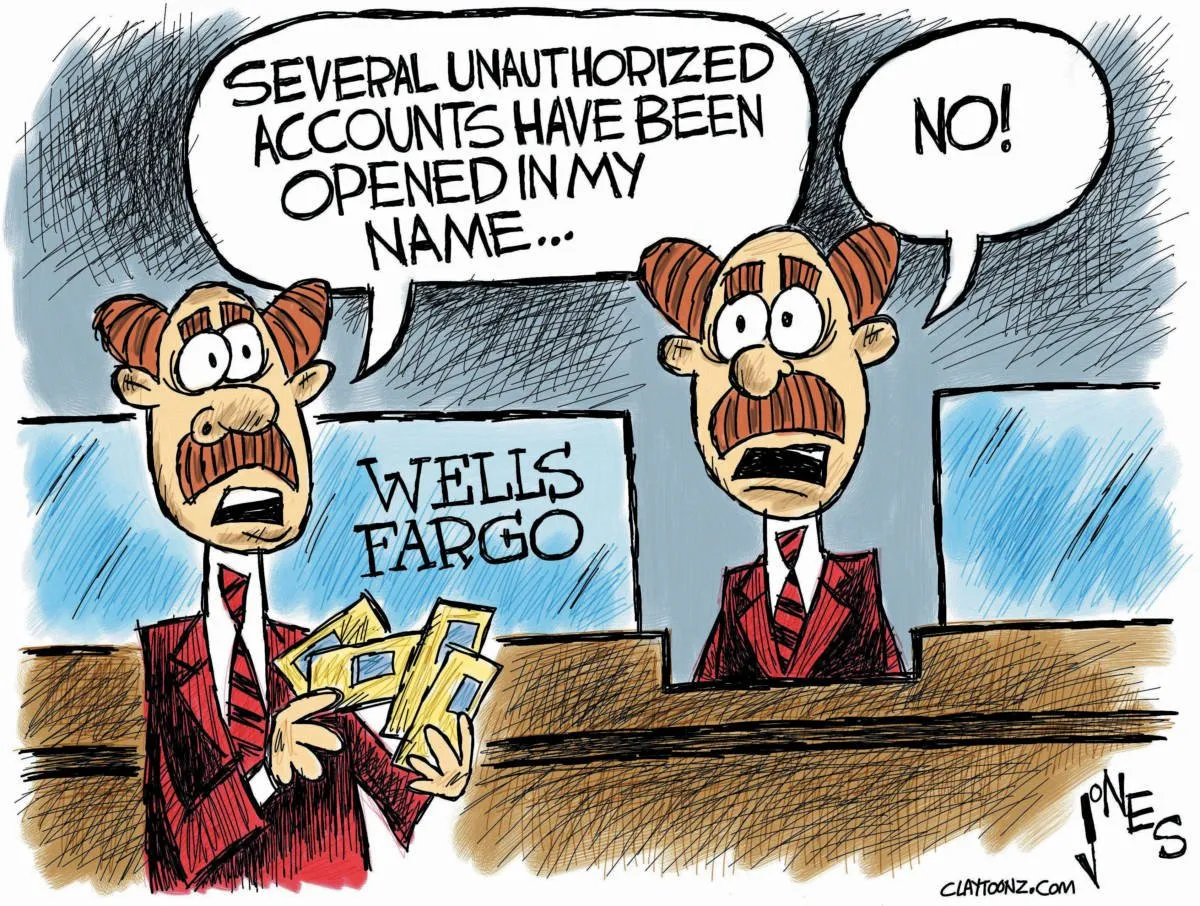

In a previous post that I wrote titled The Aftermath of the Wells Fargo Scandal, I discussed how it was recently discovered that Wells Fargo Bank had defrauded over 1.2 million people by opening accounts and credit cards using existing customers information - in some cases without their knowledge.

What has happened so far

- Wells Fargo has agreed to pay a ~185 million dollar settlement to the government after admitting that it's employees opened fraudulent and unauthorized accounts for it's customers.

- Roughly 5,300 Employees who were said to have committed these acts were fired

- $2.6 Million of a total $5 Million already refunded to affected customers for fees and interest charges incurred

- Wells Fargo has put an end to their aggressive retail sales goals that created misaligned incentives which "probably" led to the actions which put the bank in this situation

Is this enough? Why is nobody going to Jail?

By definition FRAUD is the wrongful or criminal deception or the acquisition and use of a person's private identifying information with the intention of using it for financial or personal gain. In this case, it is also known as Identity Theft which carries a maximum penalty of 15 years in prison along with a number of fines.

In the case of Wells Fargo, which probably just committed the biggest example of identity theft, no one is going to jail. The $185 million in fines might seem substantial to us lower income people, but when you look at it from a grand scale, considering Wells Fargo's $5 Billion in Revenue for Q2, it's not very big at all - only 3% - and this has been happening over the past 5 years.

The CEO - John Strumpf continues to say that he is taking full responsibility and accountability for the entire incident, however he has not resigned, he has not returned any of the bonuses he has earned, and instead has done a poor job in providing a resolution to those who were impacted - and at the same time has fired 5,300 people who were probably trying to just meet quotas in order to keep their jobs. That to me is not being accountable.

Summary

- No one goes to jail

- The bank pays a small fine

- The government gets a huge pile of cash

- The victims get some money (roughly $25 per person)

- Life goes on and the same thing happens again and again and again

Watch below as Senator Elizabeth Warren grills CEO John Stumpf at the Senate Banking Committee hearing

Do you think the punishment was enough? Let me know your thoughts?