Hello, SPIer's. Today is Sunday and we end the SPI week with our weekly dividend payment this evening and every Sunday at 21.00 GMT.

What is SPI?

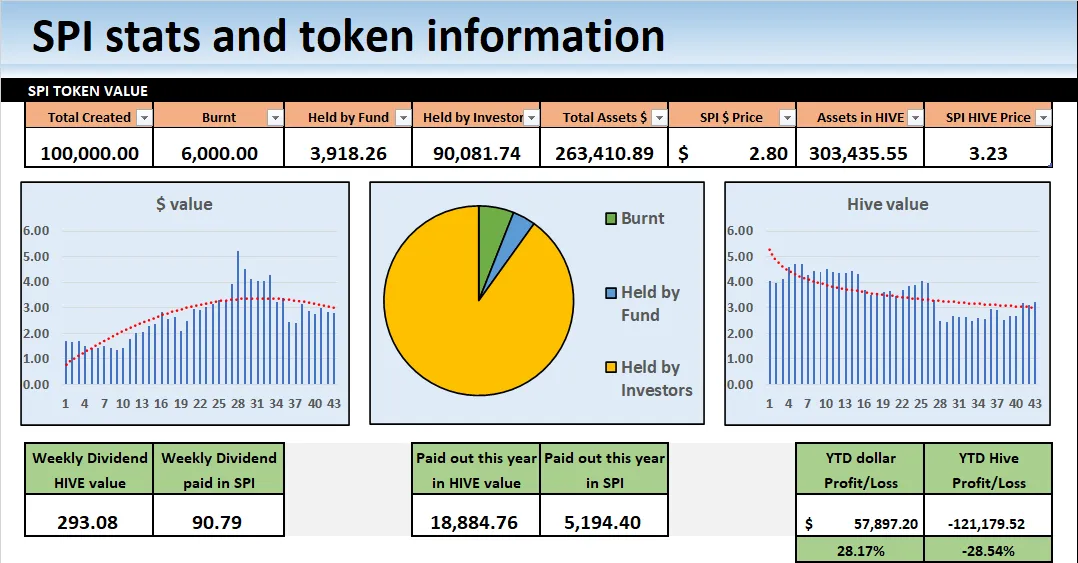

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, on STEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% more SPI's every year from weekly dividends. We raised $13k from issuing SPI tokens for the first year which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens/accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Handcapped to roughly 94,000, no more can be minted are issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

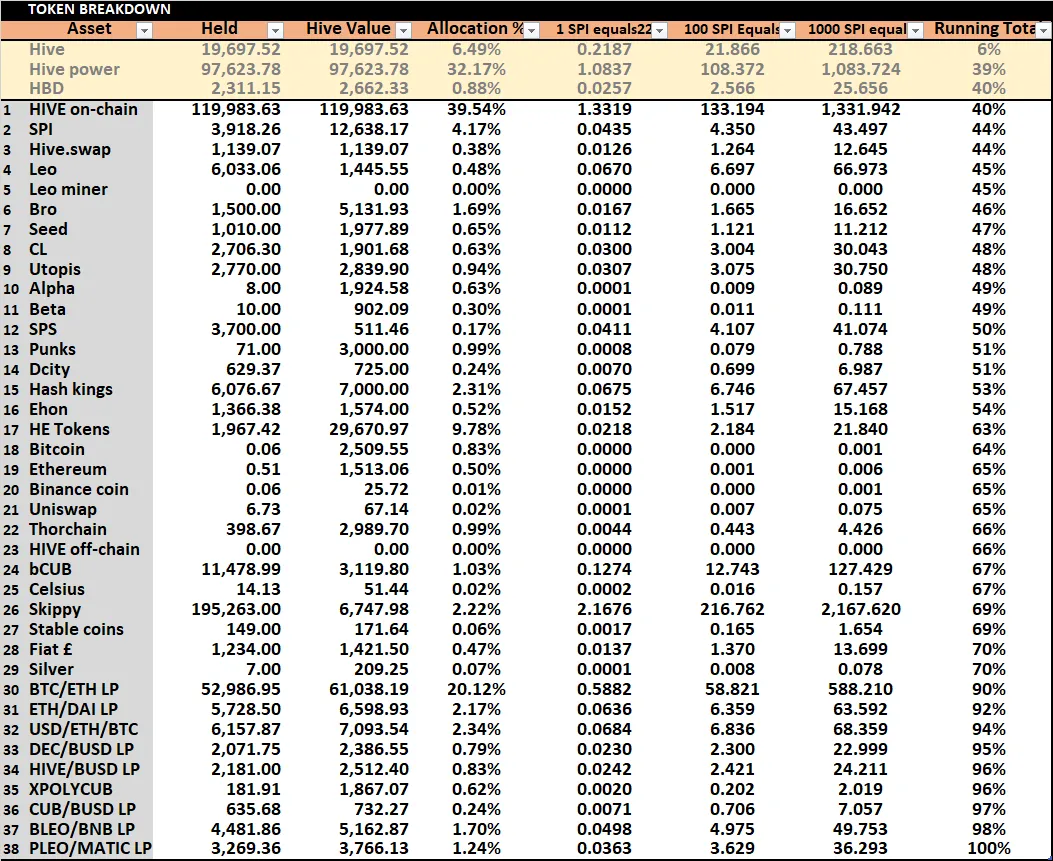

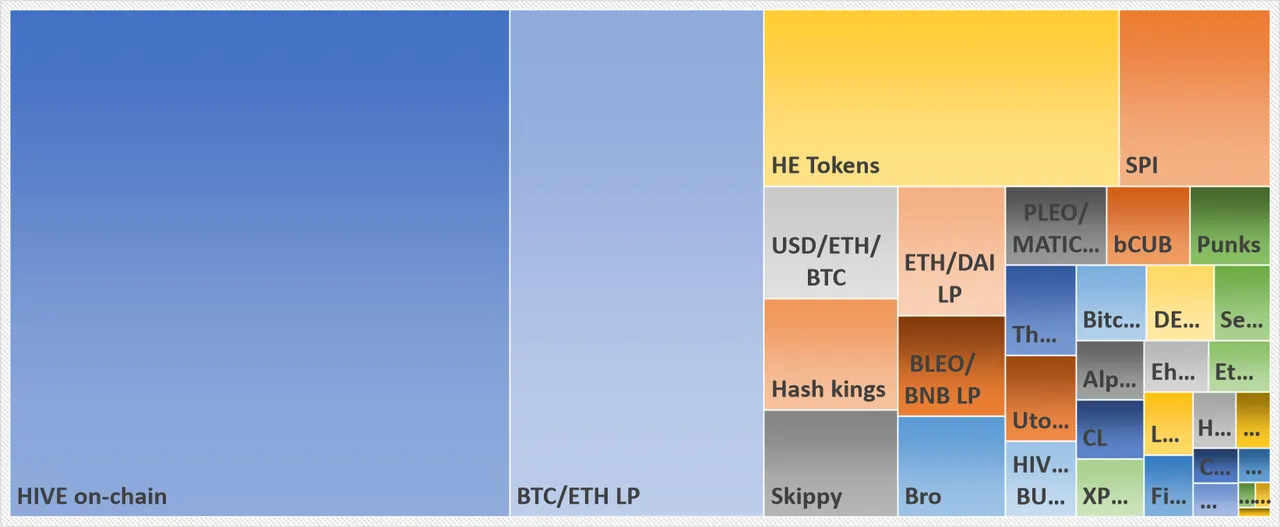

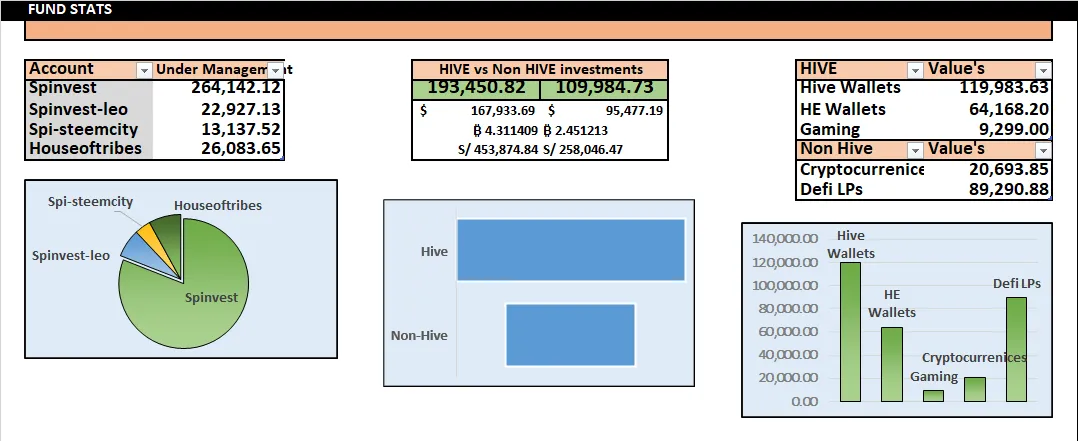

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We dont FOMO are chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Let's have a look at this week's on-chain HIVE earnings.

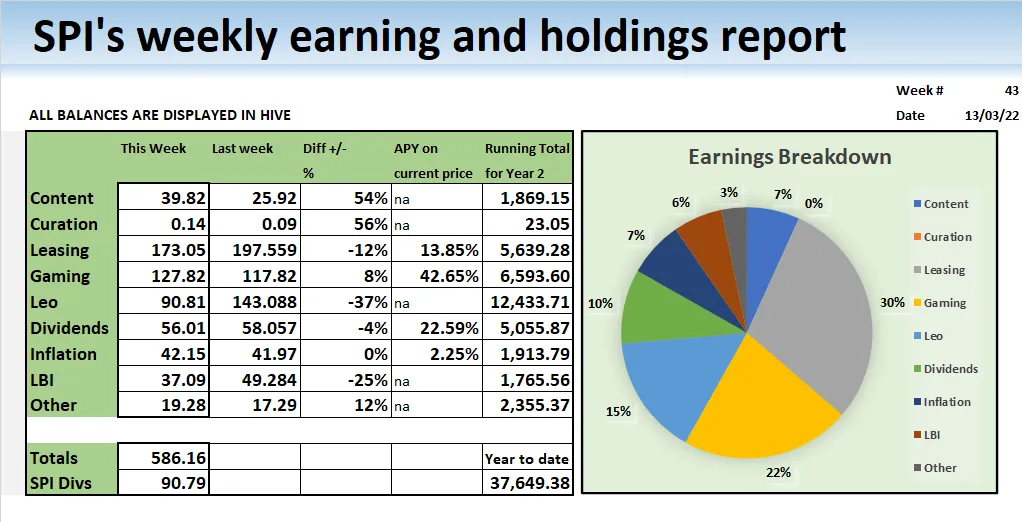

Earnings this week or much like they are every week at around 600 HIVE. This week is the last week we will be issuing dividends as SPI tokens and starting next week, SPI tokens holders will start to receive HIVE directly. I dont plan for this the ever change back to SPI which will still be bought back from the market to fund our reward pool for content producers and wallets managers and also for burning to reduce the supply from time to time.

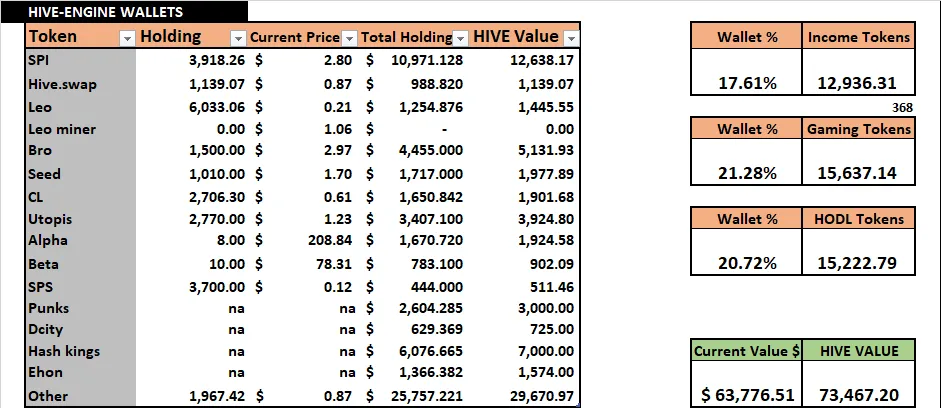

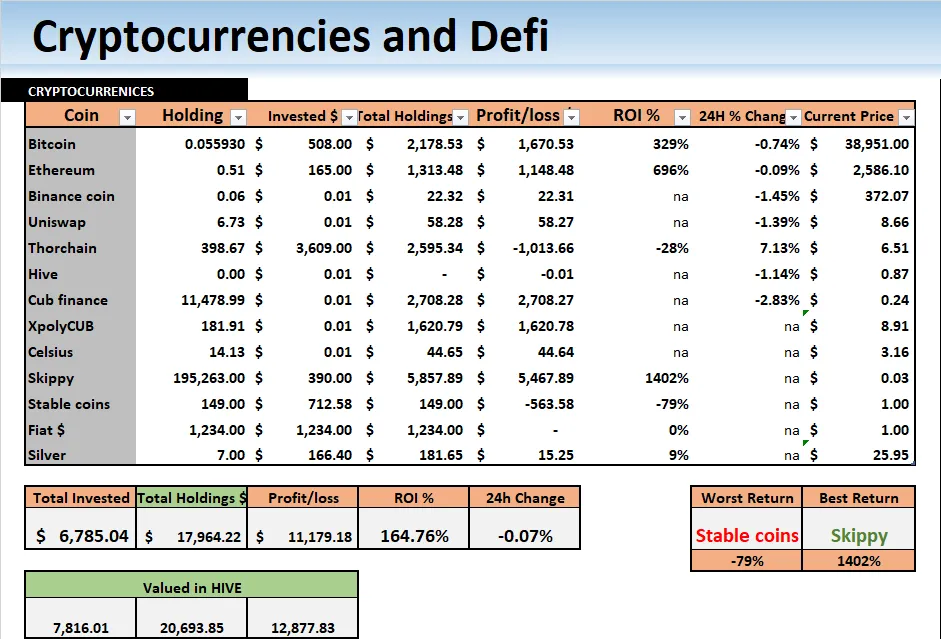

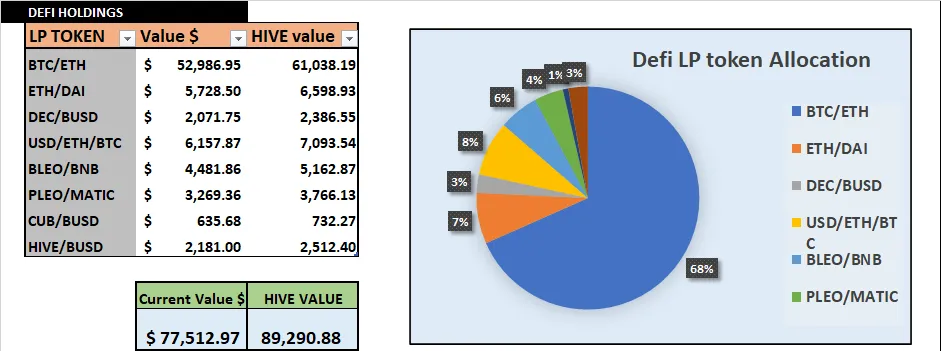

There has been some moving about of funds since polyCUB launched and you can see above that we only hold 0.06BTC and 0.5 ETH now as it's all been moved over to polyCUB in the form the BTC/ETH LP token. We have a few new investments, let me explain how they were funded.

BTC/ETH LP = 1 BTC & 6 ETH

USD/ETH/BTC = Funded from non CUB holdings on CUBfinance (BSC)

ETH/DAI =Funded from harvests

XpolyCUB = Funded from harvests and airdrops

JK for spinvest-leo is handling the pLEO/MATIC LP and a XpolyCUB vault and still holding CUB related investments on CUBfinance. He will build on polyCUB reinvesting 100% of harvests into XpolyCUB for the remaining 90 days of the airdrop.

I do not plan to keep out BTC and ETH on polyCUB forever and when the APY drops to under 25%, i'd pull the BTC out, unwrap it and put it back into safer storage until he next farm is released. Same thing with the ETH.

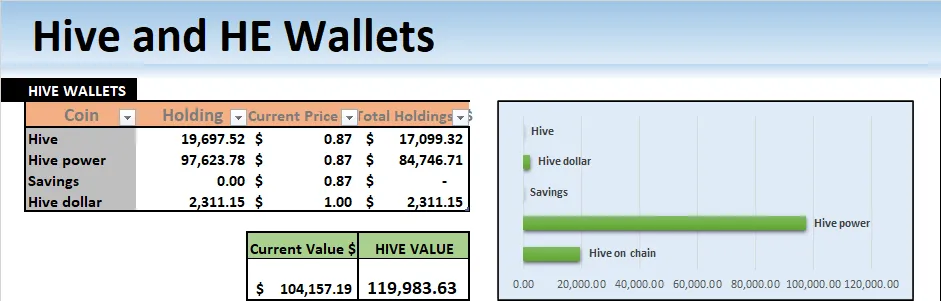

Next much change from last week, HIVE is worth a little less but our earnings on polyCUB has pretty much covered it meaning when HIVE recovers again, we are stronger. You'll notice from the chart above showing all our investments by weight has changed alot from last week with most of our bigger holdings now being LP tokens staked to either BSC or Poly CUB. HIVE is still king but with the APY's we are earnngs, it might be dethroned, dont think so but it could happen, it's crypto baby. Currently our HIVE holdings are still worth more than all our other holdings combined.

It's been a good week. When HIVE is down a few percent and the fund is worth the same as last week, it's been a good week.

As i mentioned above, SPI dividends will swap over to HIVE next week and we'll also be starting to reward content producers and people that run accounts/wallets fro us. We currently have 2 people either producing posts and 3 people running accounts, 2 when we exclude the main SPI wallet which I've not figured out how to reward yet, maybe 2% of total assets on end-year every year. I'll need to get some feedback on that as I manage alot more funds compared to others and SPI would not be liquid enough to pay me 20% of profits every year, lol. We're going to be paying out 5 SPI per post and 10 SPI plus 20% of withdrawn profits per week for those that run accounts. We currently put out 5 posts over 3 accounts and have 2 wallets being managed. We will hold about 3800 SPI which will be used to fund these rewards. I plan to continue to buy SPI's back from the market when we have extra HIVE with nothing to use it for and when i see tokens priced at 80% are lower of true value. Swapping over the dividends will be the first of a few changes with will be rolled out for a next few months. We'll finish off with an epic content i have planned.

In other news, we issued our 1st loan from @bearbonds. It's been very slow and I dont think that there is a demand for smaller loans on HIVE, maybe people dont like having to see collateral, I dont know. Thanks, Shanibeer for the idea to put an end date on it and run it as a trail. I we get 5 loans in total over 3 months, it's a success. Anyways, loans are part one, after the loan trial, we'll introduce saving. Check out @bearbonds if you are not aware of it.

Thats about all i can think of right now, that's the update for this week, have a good one folks.

Thank you for taking the time to read through this week's SPI earnings and holding report. We post every Sunday to keep our investors up to date so please follow the account if you would like to track our progress.