Today we look at STEEM and I share some analysis and strategies on how to manage everyone’s favorite vapor coin (pun intended).

I’ll start by a technical analysis of Steem (I) before touching on its fundamentals (II) and finally wrapping up with some strategies for traders and Steem investors (III).

I- The technical:

This technical analysis will attempt to understand the recent price action (b) by first looking at Steem's complete market history (a).

a- The big picture:

The charts tell us that Steem is a relatively “mature “ altcoin ( for the cryptosphere) which has already been through a complete market cycle.

Steem began trading on BITTREX in April 2016, shortly after Steemit was launched in March 2016. The coin soon went through a massive pump-and-dump-ish bubble fueled by extreme hype around the Steemit platform and by whales shenanigans.

The bubble eventually burst, spelling an almost year-long bear trend for Steem which bottomed to $0.07 around the time when Dan Larimer quit Steemit (possibly to start working on EOS).

Steem eventually rose from the dead during the recent altcoin bubble to experience a more modest, though robust, bubble, peaking at $2.52 before crashing back down to around $1.2 where it has been trading ever since.

Now let’s take a closer look.

b- The smaller picture:

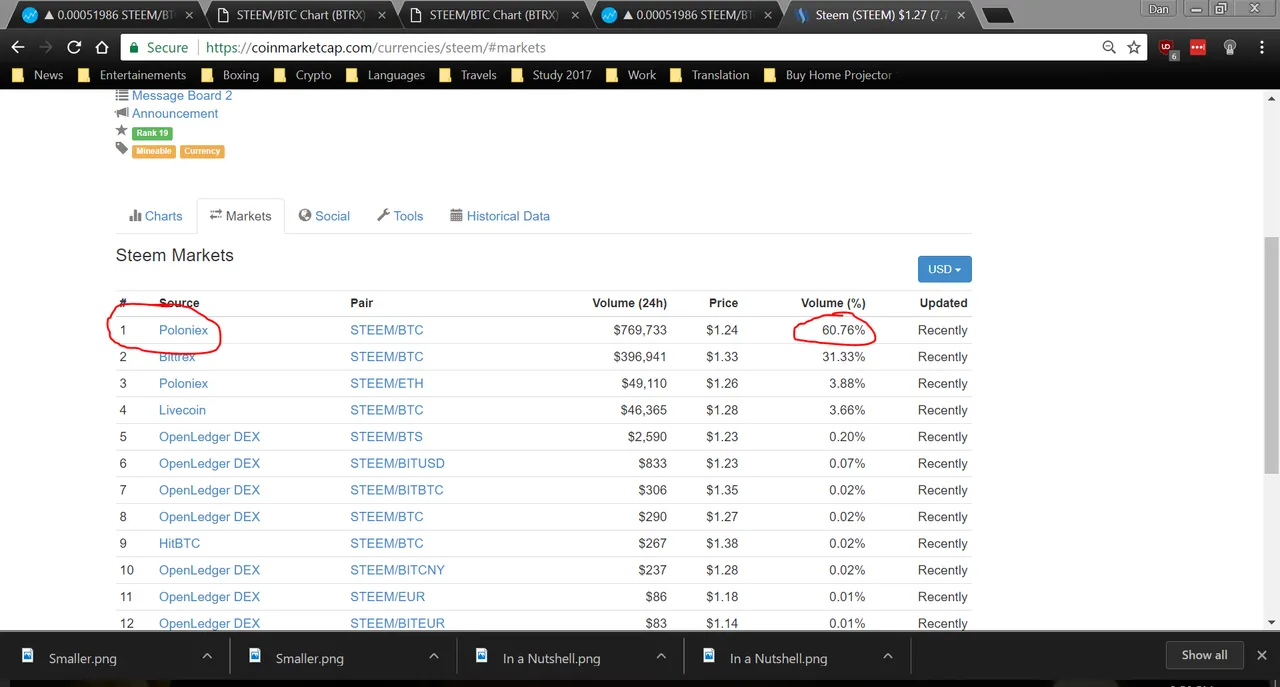

Although Steem trading historically started on Bittrex, Poloniex is now moving the "market".

...but this market ain't pretty.

I used BITTREX's chart in this example as it looks about the same as Poloniex'

Steem is trading at midrange and the price is finishing drawing a massive head and shoulder which is a typical reversal pattern (foretells more downside). Furthermore, the volume of trade has decreased considerably due to the altcoin bubble bursting and Poloniex experiencing serious issues with their trade engine and withdrawals.

Almost everything on this chart screams distribution.

On the flip side though, it is possible that Steem could find support around the current area and break out of this ugly head and shoulder to retest prior all time high.

However, as a trader or even as an investor I would definitely not buy Steem at current levels but rather wait for a better, cheaper entry.

If the price consolidates at support (price goes flat and side ways along the “Support?” line for a prolonged period of time) then it might be a signal of recovery and might constitute a decent entry. If I was already bagholding a lot of Steem I would then hang on to my coins and wait for the next spike to sell some of my Steem into strength and lock hard profits into Bitcoin, Steem power or Steem dollars;

If the price breaks down support we could see much more blood. In this case I would probably lock in some BTC profit on the break down and buy back lower (possibly at previous support or at the bottom if that line breaks too).

In any case it might be a good idea to consider cashing out of some Steem now while the price is still relatively high because, as we're about to see, Steem’s price is slave to bigger, more unpredictable, forces.

II-The fundamental:

Now I'd like to argue that it is Bitcoin which drives the value of Steem and not Steemit's user growth (a) and that Steem's relationship with Bitcoins will determine Steem's future price action (b).

a- Steem, not slave to users:

There seems to be a major misconception among some members of the Steemit community about the source of Steem's value.

That misconception is that Steemit’s user growth (which is rapidly increasing) somehow drives the price of Steem up.

In my view this just cannot be the case. The most basic market principle of supply and demand tells us that the price of a commodity decreases when its supply augment and its demand is low.

More users on Steemit means more Steem being created and thus a constant increase of the supply. As for the demand, there is none apart from new users but these would rather mine it by blogging and curating content than buying Steem from the market.

The sole purpose of Steem is thus to be spent for Bitcoin or for cash (edit: or to be re-invested into Steem Power).

For the reason above I would thus argue that user’s growth actually dilutes the value of Steem and that this fundamental trend is likely to aggravate as Steemit (the platform) grows in popularity and more and more people are drawn to the platform, high on dreams of making a quick buck and start flooding the BTC/STEEM market with sell orders.

Besides, there is a much deeper fundamental force that drives the price of Steem and that force is named...

...BITCOIN.

b- Steem, slave to Bitcoin:

Steem is an altcoin and as such its fiat value is tied to Bitcoin’s fiat value.

This relationship can work in two ways:

1. Steem’s value used to be inversely correlated to Bitcoin’s:

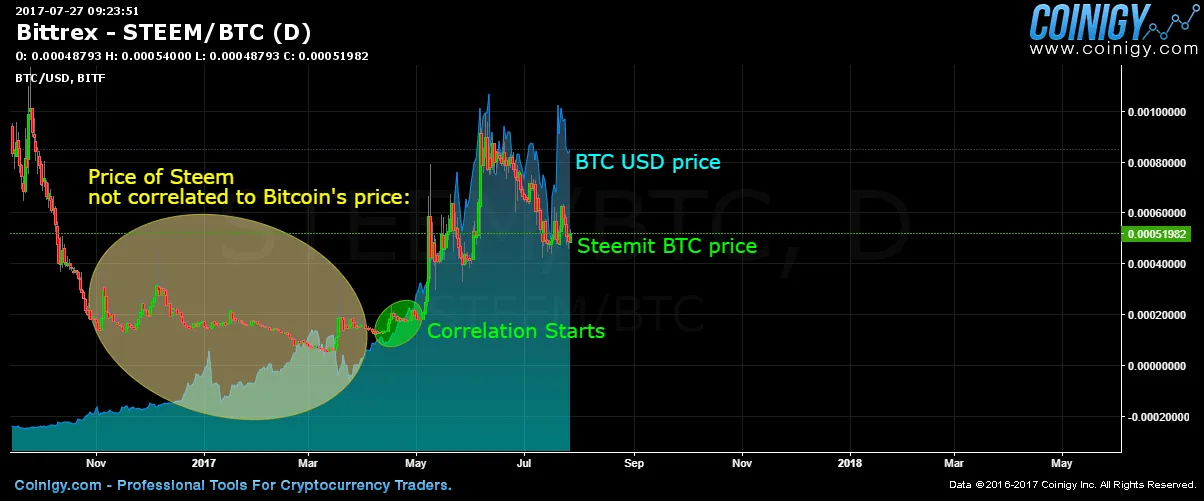

Before the altcoin bubble, the BTC value of Steem was inversely correlated to Bitcoin’s fiat value.

As you can see on the chart, the price of both currencies were moving in opposite directions until the beginning of the altcoin bubble in March-April 2017. At this point in time, both their values started to move into the same direction (correlation).

2. Steem’s value is now correlated to Bitcoin’s:

During this spring’s altcoin bubble, the fiat value (and BTC value) of Steem was considerably tied to the price of Bitcoin.

Drawn to altcoins by promises of getting-rich quick, new money started to buy Bitcoin (and also Ethereum) to get to altcoins thus increasing both the fiat value of BTC (by buying more Bitcoin) and the BTC value of altcoins (by buying more altcoins), therefore mecanically increasing the fiat value of altcoins.

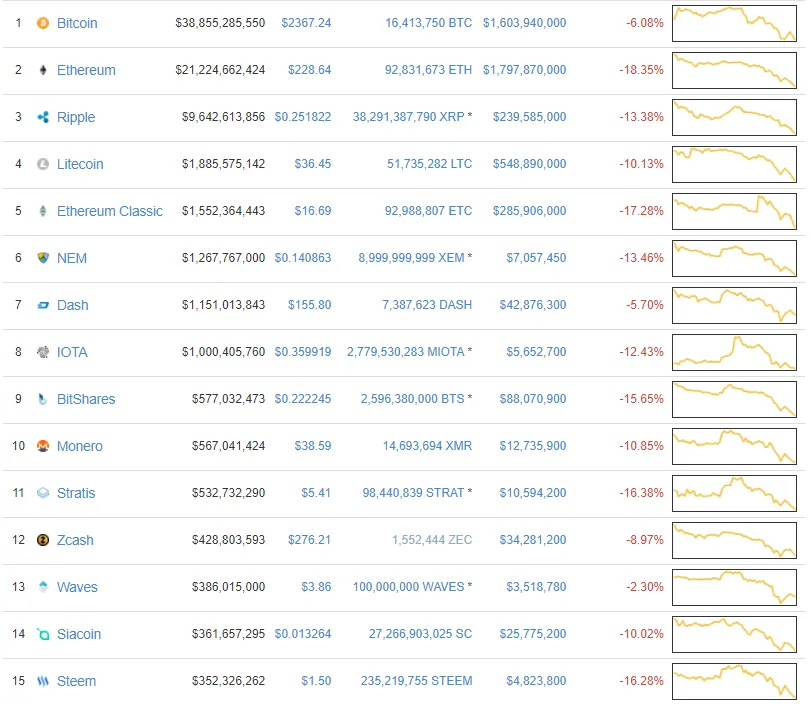

However, once BTC started to drop because of the FUD surrounding Segwit, altcoins’ fiat value also started to drop massively, leading to nightmarish charts of doom on Coinmarket.cap:

and prompting scared altcoin bag-holders to start dumping their bags, thus further crashing the price of altcoins.

This sad story of fear and dumping shows clearly on this chart:

Now, the million (Steem) dollars question:

Will Steem conserve or lose this correlation?

Well, let’s explore the different scenarios that can play out:

Steem loses its correlation to BTC / BTC’s price drops:

In this case the fiat value of Steem would probably stagnate. You would get more BTC per Steem but the BTC you’ll get would be valued less;Steem loses its correlation to BTC / BTC’s price increases:

In this case you can expect the fiat value of Steem to drop because not only you would get less BTC per Steem but lots of altcoin bag-holders could also start dumping their bags to jump on the BTC band-wagon;Steem retains its correlation to BTC / BTC’s price increase:

The “second-altcoin bubble” scenario, Steem fiat value would experience a “double-boost” and gain value very fast, similar to what happened during last Spring's bubble;Steem retains its correlation to BTC / BTC’s price drops

The worst possible scenario as both currency would lose value. If this scenario plays out, expect Steem to drop much quicker than BTC because it is traded on markets which have much less liquidity than BTC markets.

To wrap up, these scenarios plus the fundamental analysis seems to indicate that the only way Steem can really moon now is if the market undergoes another “altcoin bubble” type of scenario.

In my opinion however this is a long gone conclusion given the seasonal aspect of the altcoin markets, meaning that I wouldn't be surprised to see most Poloniex altcoin going back into the dirt for at least a few months.

Which leads me to my strategy.

III- My strategy:

I would like to conclude by sharing my personal strategy on how I will use my (way into the) future Steemit fortune:

- In crypto like in any other market, the best way of managing risk is to diversify into a range of assets, so...

I'll trade my Steemit for the exclusive purpose of accumulating more Bitcoin because at the core I am a Bitcoin believer;

I'll trade my Steemit for BTC exclusively on BITTREX because Poloniex will keep being unreliable until they update their back-end and change their trading engine which frankly...sucks;

I am not going to buy more Steem with my Bitcoin, my intention is to accumulate Steem by creating content on Steemit;

Unlike Steem power which can help you earn more Steem, Steem's sole purpose seems to be spent so why not selling some of your Steem for Bitcoin which market is more stable;

Bitcoin is going to fork soon and every person that holds Bitcoin will get free Bitcoin Cash coins which you can baghold or happily dump the very first day after the fork. And who doesn't like free money aight? This gives me another reason to spend some of my Steem into Bitcoin;

That's it for today guys, please leave your comments and don't hesitate to point out any flaws in my reasoning, this piece is meant to be an open discussion, not a definitive statement on the future of the market. As always in crypto, you can never now for sure and it's all just a big game of ifs and maybes.

#cryptocurrency #bitcoin #steemit #steem

Trade safe guys, and please follow and upvote if you like the content.

Dan @tradealert