Before going into matter I would like to establish that I do not want to advertise any Cryptocoin in particular, I just want to make a point of support to show where my ideas derive from.

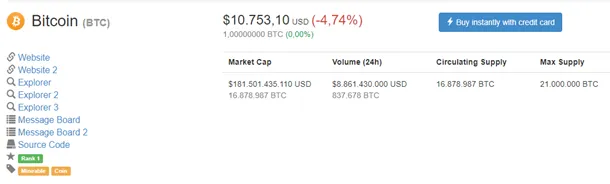

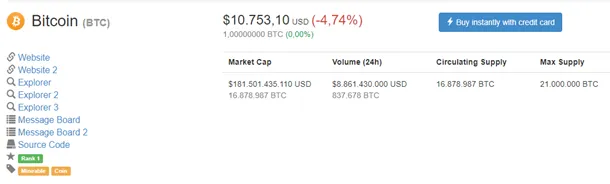

A few months ago I read many opinion and media saying that a Cryptocoin should not have a backup and that this should be based only on the confidence generated by these Cryptocoins, a perfect example of this situation has always been the BTC , which only in December last year framed a historic milestone of a value of $20000.

This has driven me to conduct an investigation to see how true this is in the world of Cryptocoins, recently this theory of Cryptocoin without backing became more frequent with the departure of a centralized Cryptocoin first generated by a Government of a country, I am talking about Petro (PTX), which according to its White paper establishes a support in the oil reserves with which the country counts. One of the weaknesses that has criticized him is related to this theory, among others.

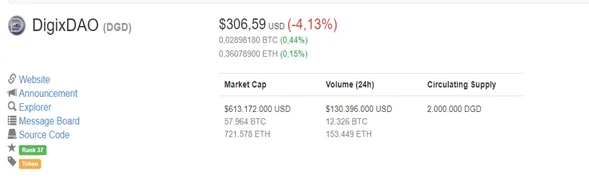

In the investigation I have encountered this criptomoneda that already many should have heard his name is Digixdao (DGD).

>Digix is one of the projects belonging to the Ethereum platform, the main idea is to attract physical goods to the blockchain, taking advantage of the versatility, transparency and security of Ethereum.

Basically it is to transfer the most popular existing asset, gold Bullion and consider it as a token (DGX) and then implement other goods such as silver, platinum and other commodities.

The company is founded in Singapore, the perfect location as it is considered the Swiss of Asia, as it provides facilities for this type of organizations and is a great help for legal issues.

The team is formed by several experts in technology in the space of blockchain and are being advised by the same Vitalik Butterin.

There are 2 types of DGD and DGX tokens which have different objectives but are complemented for the efficiency of the business model.

DGX will use a protocol called proof of asset, this means that each DGX Token is backed by 1 Gr. Of gold, which is acquired through LBMA (London Bullion Market Association) and certifies that it is gold 99.99% pure, these are implemented in The blockchain of Ethereum through intelligent contracts and can be divisible up to 0.001 gr.

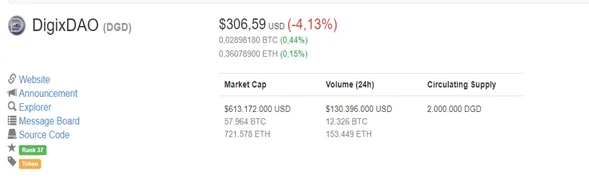

DGD is the Token works as an action of DIGIX, there are 2 million and they had their crowd sale (ICO) in the month of March of 2016, with a limit of $5.5 million USD that was reached in less than 12 hours, approximately 450.000 ETH, which is currently equivalent to $22.5 million Usd.

Source

These people raise in your project that you cannot talk about a decentralized future if the physical assets we use today are excluded.

So far we know that there are criptomonedas that if they have backup long before the PTX perform its launch, but let's go to the important as it is its performance since its creation, for this I want to fix in a specific space given in time, space Perfect will be when the whole market was low or red numbers this includes the months of January-February of the year in Cure 2018.

Let's see his history in those months of Digix compared to the most popular Cryptocoin at the moment that is the Bitcoin, the final only interest us in the results in the market.

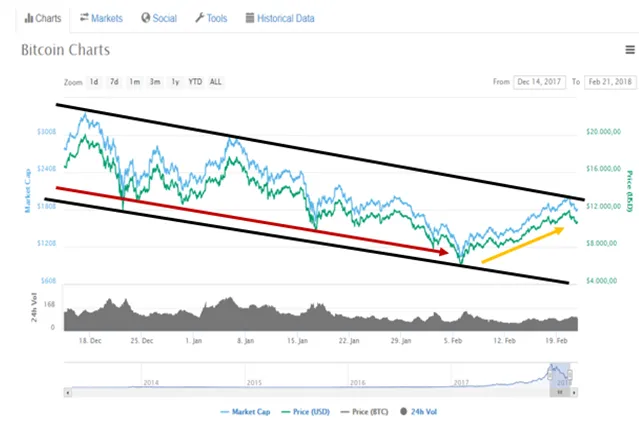

As we can notice in the history that was taken from the Web portal https://coinmarketcap.com/. We focus our attention on the Green Line of the graph that represents the values in dollars. We realize that the behavior of this Cryptocoin during these two months was gradually downward to reach its lowest point that was presented in $5800 and in the last two weeks has presented a recovery in their prices.

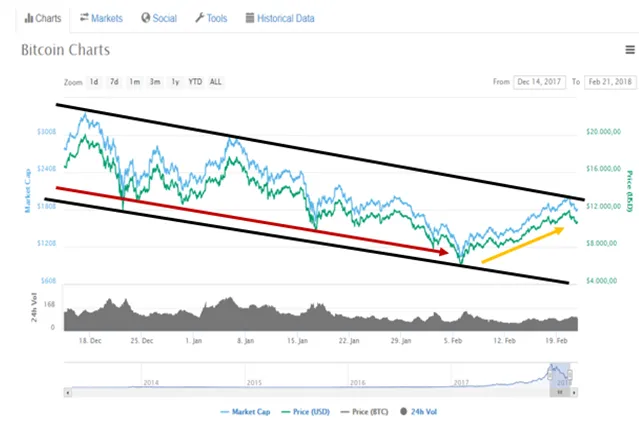

Now check with the behavior of a Cryptocoin with backup as is the DigixDao (DGD) that currently remains in position 37, in the same period of time that was analyzed the BTC being the number 1. For this graph we should focus our attention on the green and Yellow Line presented in the graph, being the green representation of the value of the dollar and the yellow value of the Cryptocoin in study with reference to the BTC.

I do not know but I have been surprised with the stability that has had this Cryptocoin, while all the Cryptocoins reflected low numbers in their prices, this Cryptocoin had the ability to maintain their prices and still increase them realize that Has never come down from its initial value has always stayed above. This can allow me to say that the backup gives you some stability in the market.

Now with all that has been raised will it be bad that the Cryptocoins begin to have support in tangible assets?

I hope you can draw your own conclusions and leave your comments on this subject.